Tag: Sport

-

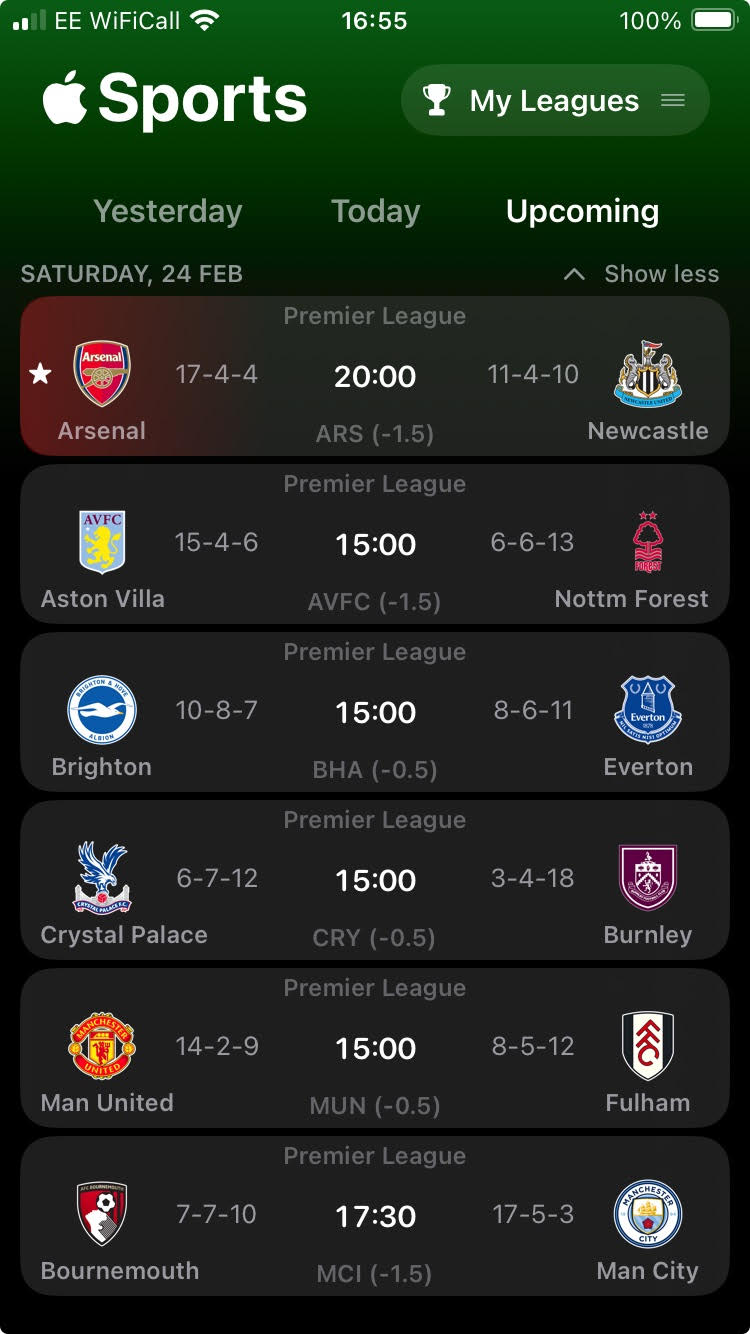

Apple’s Sports App

This week Apple launched a new app entirely devoted to sport. Apple Sports is initially available in the US, Canada and UK, and has a relatively small list of features. You basically pick which leagues you’re interested in, and which teams within those leagues you follow, and it’ll happily provide you with things like line-ups,…

-

Sports Numberwang

I’m really only posting this, because I spent a bit too much time putting together a Thread of a response to a clickbait-y post about the major sporting events’ viewerships. I really shouldn’t rise to the bait, but… The Threads algorithm threw up this post. (A reminder that “Verified” just means someone who is willing…

-

Rebundling Sports in the US

Interesting news in the US, where Disney, Warner Bros Discovery and Fox have announced a new as-yet-unnamed streaming service that will combine all their sports offerings into a single subscription. Combining the resources of ESPN, ESPN2, ESPNU, SEC Network, ACC Network, ESPNews, ABC, Fox, FS1, FS2, BTN, TNT, TBS, truTV and ESPN+ into a single…

-

Premier League Rights 2025/26 – 2028/29 UK TV Deal

This evening, the first games in Amazon’s deal for TV rights to two rounds of the Premier League get underway. But Amazon’s coverage ends after next season’s Festive period games, because from the 2025/26 season, they will no longer have live rights. Amazon, you will recall, have the rights to a midweek round of games…

-

Premier League UK TV Rights – More Games, Fewer Packages

Regular readers will know that I’m a little obsessed with the TV rights to Premier League football, and I only last wrote about the upcoming rights round a month ago. According to the very well connected FT (£), the Premier League is likely to offer fewer rights packages this time around, but with more games…

-

Premier League UK TV Rights

There’s a good piece in the FT from earlier this week (£) that examines the forthcoming kick-off the next set of UK Premier League TV rights. The current set of rights agreements expire at the end of the 2024/5 season, and with the 2023/4 season just getting underway, it means that the time is right…

-

Why is Everyone Trying to Sell Me NFTs?

OK. I do know why. Easy cash. But I loathe just about everything NFTs stand for. Right now we’re in a few days into the Winter Olympics – a games that I’m not overly interested in, if truth be told. The timezone is bad for Europe, the pandemic means that there are sparse crowds at…

-

The Olympics on TV in the UK

The 2012 London Olympics were perhaps the high point for UK viewers who wanted to watch the Olympic Games. For a home event, the BBC pulled out all the stops with coverage across BBC One, BBC Two and BBC Three (then still on broadcast). There was a vast array of other broadcasts too, with up…

-

Wimbledon 2021

It’s been an awfully long time since I last attended an actual in-person sporting event, so it was great to be able to get a ticket to Wimbledon this year. Prior to the pandemic Wimbledon had finally gone digital in their ticket allocation. Previously, to enter the public ballot, you had to send away for…

-

When Should Athletes Get The Vaccine?

Note: This piece expands a little on a Twitter thread that I published earlier today. Today it was reported that the UAE Team Emirates cycling team had all received the Chinese Sinopharm Covid-19 vaccine while they attended an Abu Dhabi winter training camp. The team counts among its members, the 22 year-old Tour de France…

-

Amazon and Rugby

This weekend the hastily arranged Autumn Nations Cup competition kicks off, with eight European nations playing each other in two pools initially before a finals weekend determines the winner. The competition is there to replace the usual Autumn internationals made up of southern hemisphere sides playing a series of big games in Europe. I’m sure…

-

The Premier League in an SVOD World – Running the Numbers

This week, Amazon Prime in the UK has begun the first of its streaming-only games offered to Prime subscribers. You will recall that during the last UK round of Premier League TV rights, a package comprising of the entirety of one mid-week “matchday” and all the Boxing Day games was offered. In the end Amazon…