Note: This is a subject likely to be of even more niche interest than many of my other blogs here. You have been warned!

Yesterday Sky announced that it had reached agreement with Netflix to add Netflix to their Sky Q platform. What this means is that Netflix programmes will appear within the wider Sky Q ecosystem. It means that individual programmes will be promoted without necessarily having to dive into a Netflix “app” as you would on many TV platforms.

On Twitter this raised a few questions: Sky’s on BARB, so might we see ratings for Netflix in due course? Does this mean that Sky will know what their customers are watching on Netflix?

The first thing to say is that this Sky deal isn’t unique. On Amazon’s Fire TV platform, for example, individual Netflix programmes are recommended alongside Amazon’s own shows. You can dive straight into an episode of Stranger Things if you want to (and have obviously previously logged into your Netflix account). And that probably means that Amazon has some idea of what programmes their customers are watching.

I’ve no doubt that the carriage agreement between Netflix and Amazon stipulates that data can’t be shared, since as we all know, Netflix doesn’t publish ratings figures. But Amazon probably has some view on that. Of course, it’s only a partial view since there are a multiplicity of ways to get Netflix on your TV, from built in Smart TV apps, to games consoles, Chromecast, Apple TV and many others. But you know, if you have a big enough sample… I’ll return to samples later.

It’s worth noting that a multiplicity of companies potentially have some kind of awareness of how Netflix is performing. Netflix has a complex Content Delivery Network (CDN) globally to ensure that you get what you want when you want it and where you want it. More importantly, some larger Internet Service Providers (ISPs) are part of Netflix’s Open Connect network. In other words, the ISPs cache Netflix’s programming locally on their own data servers, speeding up delivery time to viewers, but also saving the ISPs money in terms of connectivity with the wider internet. Both the CDNs and ISPs have the potential to understand in great detail what is being consumed (albeit there may be encryption and obfuscation to limit or prevent this).

One thing that Netflix being on Sky doesn’t mean is that there will be BARB data. Recall that Netflix is already on other TV platforms such as Virgin Media. It’s also worth noting that even if all parties wanted to, BARB isn’t really set-up to provide meaningful data at this granularity, and that’s to do with sample sizes.

There are about 26m TV households in the UK, each of which has one or more people. BARB is the UK TV ratings organisation and it recruits a panel of households that provide detailed viewer data which is used to determine overall ratings. There are roughly 5,100 BARB households, with each BARB household representing around 5,000 other households.

That’s a decent sample; it’s large enough to provide robust data on programmes across the larger TV networks. (Things do get a bit more complex with smaller channels, and I’m always wary of anyone telling you how few people watched a show on a minority interest channel, since the sample doesn’t really cater for it). BARB has to work across each TV region, since advertising is sold on a regional basis.

But back to samples, and specifically Sky Q. How many Sky Q households are there in the UK?

In late January, Sky’s results for the six months until 31 December 2017 revealed that there are now 2m Sky Q homes in the UK and Ireland. BARB only measures UK TV viewing, but we’ll use 2m as a working number, alongside 26m TV homes. BARB needs to make sure that it’s panel is reflective of how people actually watch TV – the right number of Freeview, Sky Q, Sky+, Freesat, Virgin Media homes and so on.

Sky’s figures suggest that 7.7% of UK homes, roughly, have Sky Q. If that’s replicated in BARB’s 5,100 panel, then we’re talking about 392 BARB households with Sky Q.

In a paper published in January 2018, BARB says that 7.5m homes have Netflix subscriptions in the UK, or 22% of homes (This is based on a large survey that BARB conducts called the BARB Establishment Survey. It’s used to ensure that BARB knows properly how the UK public is watching TV and video).

As things stand then, assuming that Netflix subscribers are spread evenly across all TV platforms (a massive “if”), then we need to further reduce our sample to find Sky Q homes who currently have Netflix. It seems likely that current subscribers would be able to link their accounts to the Sky Q platform, and of course Sky and Netflix would like to see subscriber growth coming from those homes.

Let’s be generous and assume that instead of 22% of Sky Q homes having Netflix, it’s likelier to be closer to 50%, based on the greater disposable incomes of those households and them likelier to be earlier adopters. That means our sample is down to 196 homes. And that’s a very small sample to start trying to model what those households are watching on the Netflix platform.

This is all moot anyway, since unless Netflix changes tack radically, they don’t need to join ratings bodies like BARB. They’re not an advertising led business (the reason commercial services need BARB), and they know precisely how much their shows were streamed.

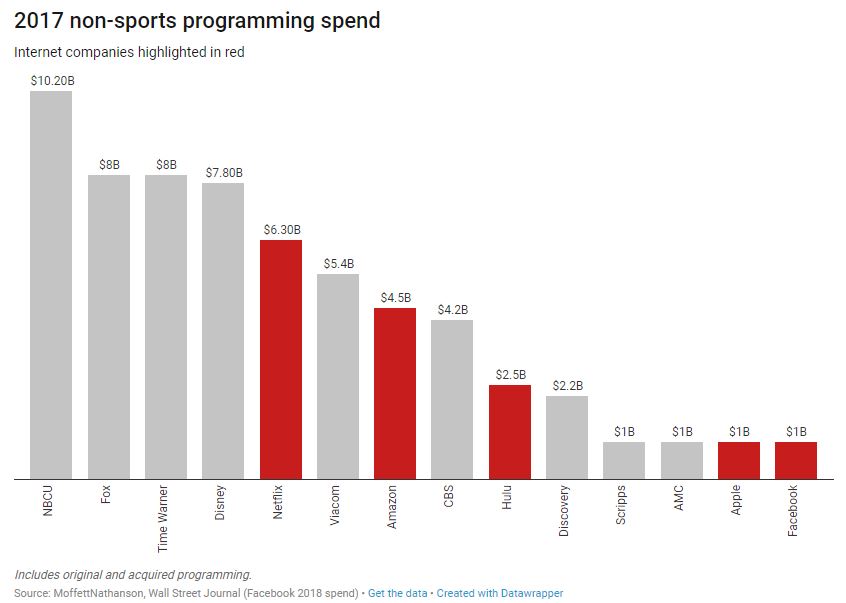

These digital providers are rolling big dice. Netflix says that it will spend close to $8bn on programming this year. Amazon is expected to spend $5bn. Facebook and Apple have promised to spend big too.

Recode has an interesting chart that puts 2017 spends in context.

But we probably need to contextualise that a little because Netflix and Amazon are spending globally, while many of the other players on this chart are predominantly US companies with relatively little ex-US programme spending.

I’m not sure where any of this gets us except that these digital streaming platforms are going to be everywhere even more, and we’ll probably never get a clear picture of how popular much of their programming really is.

Comments

One response to “On Sky Q, Netflix and BARB”

[…] is definitely spending a lot, although it’s in the ballpark of what other large media companies also spend each year. But it’s not launching new series at the rate of two a […]