Tag: Video

-

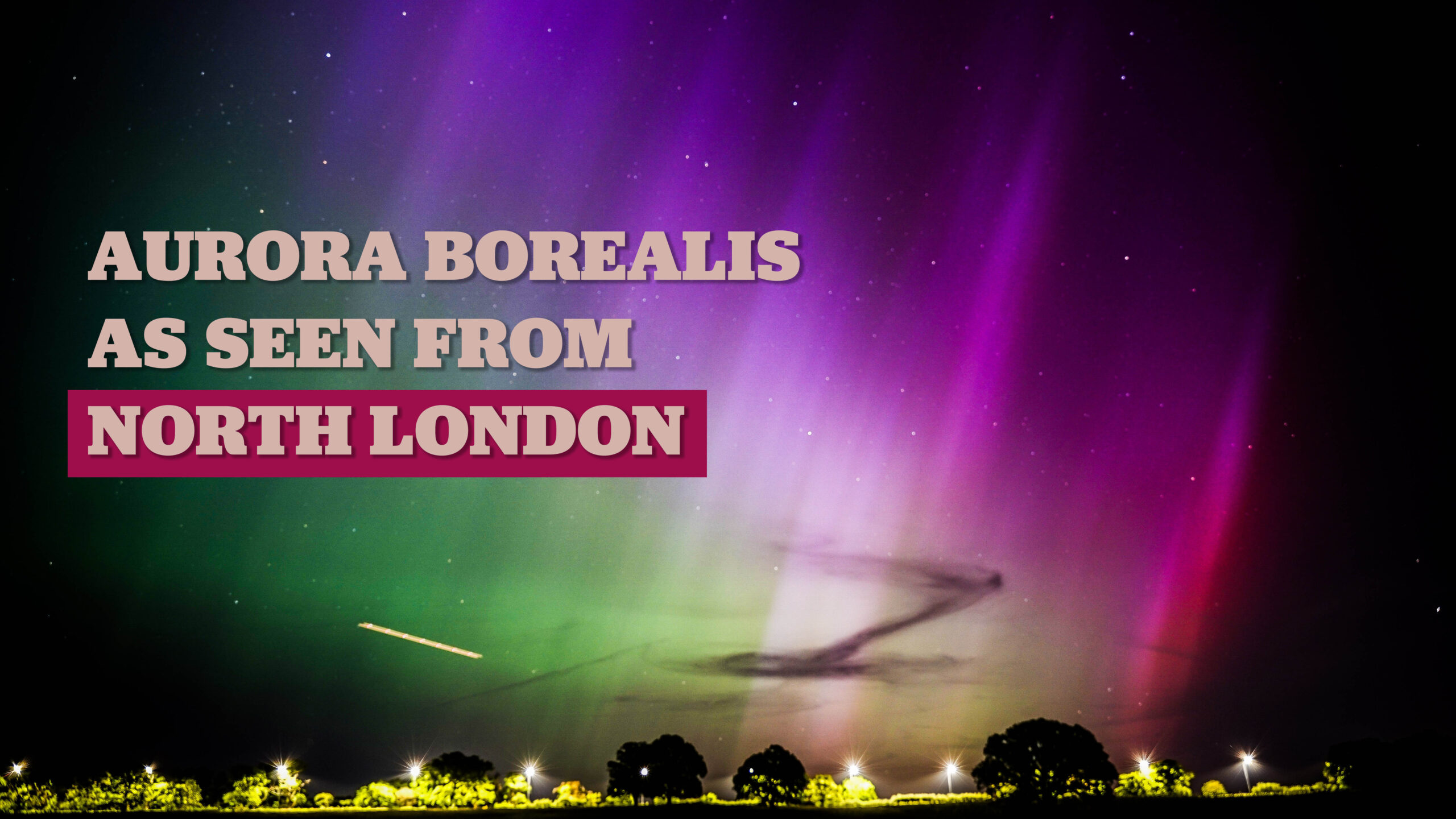

Aurora Borealis – Video

During the excitement on Friday (and early Saturday), I shot a few minutes of video footage which I’ve embedded above. This video has been sped up about 4x speed to show the lighting effects better off.

-

Algorithmic Promotion Shouldn’t Be Everything…

As an addendum to my last blog on the lack of physical media for the leading Oscar contender, Everything Everywhere All At Once, I thought it was worth seeing how sharp the streamers have been reacting to yesterday’s Oscar nominations buzz. The nominations came out on Tuesday lunchtime, UK time, and I’m writing this a…

-

Everything Not Everywhere on Home Media

Yesterday, the 2023 Oscar nominations were announced, and the film with the most nominations was Everything Everywhere All at Once with 11 nominations including Best Film, Best Director, Best Actress, Best Supporting Actress (x2) and Best Supporting Actor. I know I’m banging a bit of a drum on this subject, but why on earth can’t…

-

Rain, Wind and a Tyre Blowout

Saturday’s ride was always going to be a little interesting. The weather wasn’t great, with rain falling fairly constantly early on. I prevaricated a bit, but decided to do 100km or so circuit around Hertfordshire. So fully layered up in Gore-tex and waterproof shoe covers (which never stay fully waterproofed), I headed out. All was…

-

A New Year’s Day Ride to Cambridge

Starting the year as I mean to go on, I rode to Cambridge on New Year’s Day, taking a slightly circuitous route to stretch it out to 100km. A quick ride through the city centre before heading back to the station for the return leg by train.

-

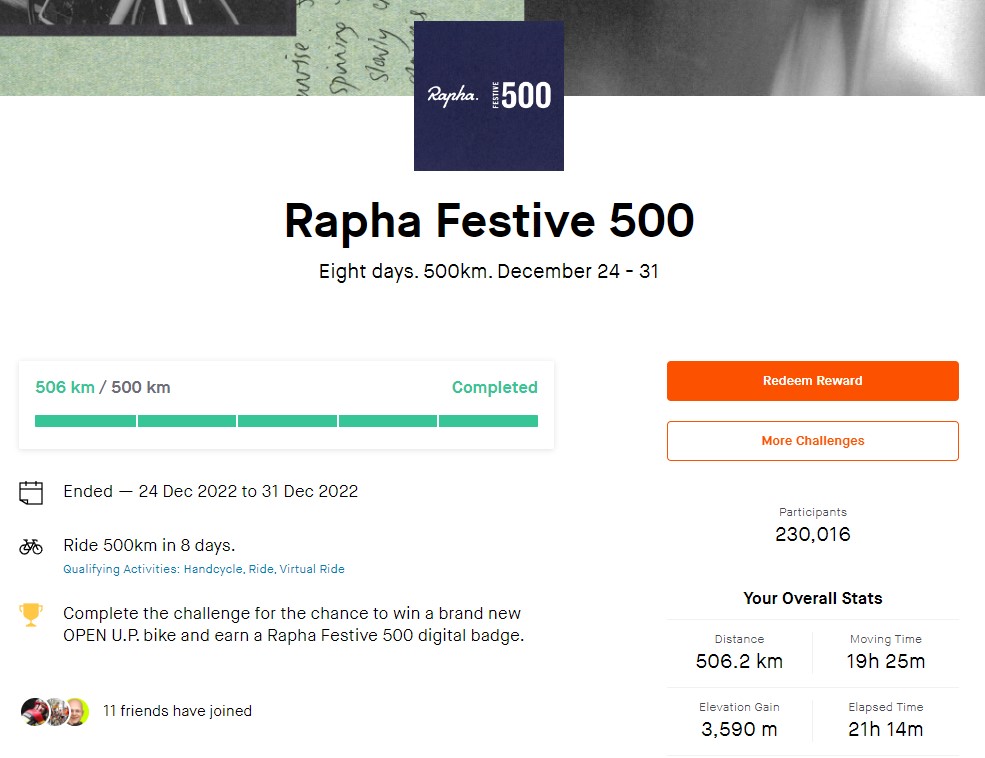

The Rapha Festive 500 – 2022 Edition

For the second year running, I decided to embark on the Rapha Festive 500 challenge – riding 500kms between Christmas Eve and New Year’s Eve. I’ve already documented a couple of this year’s rides. Here’s Ride #1, Ride #3 and Ride #4. I didn’t take a camera out with me for Ride#2, and while I…

-

Festive 500 – Ride #4

Ride #4 of this year’s Festive 500 was the longest of my rides so far, heading out in the pre-dawn from Sheringham on the North Norfolk coast, southeast along the coast through Cromer, Overstrand, and down to Winterton-on-Sea where the seals gather on the beach. I stopped for a warm tea at the van (it…

-

Christmas Eve 2022 – Festive 500 Ride #1

I’m doing the Rapha Festive 500 this year – riding 500KM between Christmas Eve and New Year’s Eve. This was my first ride on Christmas Eve when it was damp and therefore very muddy. Not shown here is me cleaning the GoPro lens many many times during the ride. This was a ride between Sheringham…

-

Boxing Day 2022 – Festive 500 Ride #3

I’m doing the Rapha Festive 500 this year – riding 500KM between Christmas Eve and New Year’s Eve. This was my third ride on Boxing Day which was gloriously sunny if still cold. This was a ride between Sheringham on the North Norfolk coast and Norwich. The full route is over on Strava. So far…

-

Trent Park in the Snow

It properly snowed in London last night for the first time in a few years, so I went out in the pre-dawn snow on my E-MTB and my drone to capture some of the beauty of the countryside around Trent Country Park. There’s a lovely path leading from close to Chase Farm Hospital that takes…

-

Repairing a Garmin Edge Mount

[Now updated with changed fix!] This week I had an accident on my bike and crashed in the rain on my commute to work. No damage to my bike… or to me. But my Garmin Edge 1030 bike computer came off the worst, getting detached from its mount on impact, and damaging the mount in…

-

Waves

A short slow motion video shot with my Pixel 6 Pro over Christmas. Not the biggest waves in the world, but they’re always lovely slowed down.